The term ‘Tax’ is derived from the Latin word “Taxare” which means “to asses” or “to estimate”. Over time, the term evolved from the old French word “taxer” into English, meaning a compulsory financial charge imposed by a government. Historically, taxes have been a fundamental tool for governments to generate revenue for public expenditures.

A tax is a financial charge or levy imposed by the government on individuals, businesses, or goods and services. It is a specific amount that people or legal entities compulsory pay based on their income, profits, or transactions. For Example: Income Tax, VAT, etc.

Where as Taxation is the legal process by which a governments imposes and collects compulsory financial charges(taxes) from individuals and business to generate revenue for public services and development of country in various aspects, Such as: Education, Roads and Infrastructure, healthcare, defense and national security, social welfare programs, public Administration e.t.c

Definition

- According to Prof. carl copping plehn: Taxes are general contribution of wealth levied upon persons, natural or corporate to defray expenses incurred in conferring common benefits upon residents of states.

- According to Bastable: “A tax is a compulsory contribution of wealth of a person or body or persons for the service of public powers.”

Tax is computed and paid as prescribed in the law. If the person defies the tax payment, s/he may be punished in the court of law. Hence, Tax is not a voluntary payment or donation, but an enforced contribution imposed by the government.

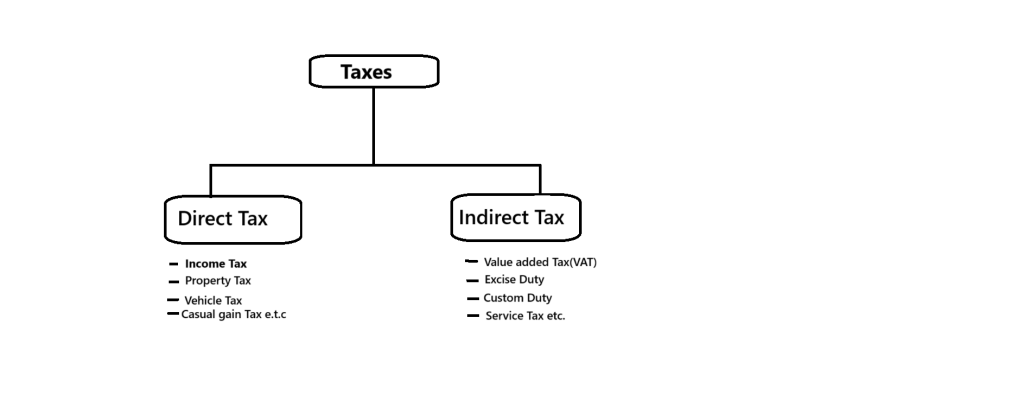

Kinds of Taxes

Taxes is broadly categorized into two main types based on how taxes are imposed and collected:

1. Direct Tax

Direct tax ia a tax levied on income/Profits of people. It is paid directly by citizen or businesses to the government or it is levied directly on a taxpayer who pays it to the government and cannot pass it to someone else.

The taxpayer pays tax directly to the authority imposing the tax. In Direct tax, Impact and Incidence is on the same person. In other words, the person who is liable to pay tax(impact) and the person who bears the tax burden(incidence)are on the same person because the liability to pay direct tax cannot be passed to someone else.

For Example: In Income tax, If a person earns 1,00,000 rs and has to pay 1000 rs as income tax, S/he cannot shift this tax burden to someone else.which refers the tax impact and incidence is on the same person.

Types of direct tax

(a) Personal Income tax: It refers to that kind of tax which is imposed on income of person that is being earned in a financial year.

(b) Corporate Tax: It is a tax which is imposed on companies. where the company pays tax on the benefits earned from the business.

(c) Capital gains tax: It refers to that kind of tax which is imposed on the profit earned from selling a capital asset, such as real estate, stocks, bonds, gold or other valuable investment.

(d) Wealth Tax: It refers to that kind of tax which is levied upon the property owned by individuals such as land, building, gold, e.t.c.

(e) Other taxes: These taxes include taxes like gift tax and estate duty.

2. In direct tax

In Direct tax is a tax levied on the consumption of goods and services. It is not directly levied on the income of the person. Instead, the person has to pay the tax along with the price of goods and services brought by the seller.

In Indirect tax, The impact and incidence both are on the different people. Here,the seller pays the tax to the government(impact) but the consumer bears the final cost(incidence) so, we can say that the consumer indirectly pays the tax to the government because the tax amount is included in the price of goods and services they purchase. The seller collects the tax from consumers and then transfer it to the government. So, Every time when we buy something, we are indirectly paying taxes to the government.

For Example: The price of petrol is 100 rs per liter, but the government imposes 40 Rs as excise duty and VAT, the petrol pump owner sell the petrol at the price of 140 rs per liter to the consumer, where the owner out of the 140rs, he keeps 100rs and pay 40rs to the government as tax. So here, we indirectly paying 40 Rs tax on 1 liter of petrol.

Types of Indirect tax

(a) Excise duty: Excise duty is an indirect tax paid to the government by the producer of goods. It is typically applied at the manufacturing or production stages of goods. It is mainly levied on that kind of goods which is harmful to human health, the environment, and also to luxury items. Such as: petroleum, alcohol, cigarettes, cosmetics, perfumes, etc

(b) Customs duty: It is a tax imposed on import and export of goods.

(c) Value added Tax: A tax on the value added to a product at each stage of production or distribution.

(d) Entertainment Tax: It is a tax levied on entertainment activities like movies, concerts and amusement park.

(e) Stamp duty: A tax imposed on legal documents related to transactions like property sales, shares, or agreements.

Features of Direct and Indirect Tax

1. Direct tax

- Tax Burden cannot be shifted to others

- It is based on income or ownership

- It is progressive (higher income-higher tax)

2. In direct tax

- Burden can be shifted from the seller to the buyer.

- Regressive in nature (affects Lower income group more)

- It encourages and discourages consumption ( for example: High Tax on Cigarettes, alcohol.

Helpful